The best strategy combines multiple touchpoints: SEO-optimized content, social ads, gated lead magnets, and smart lead forms. Forms should be multi-step, personalized, and built to guide users smoothly toward conversion.

5 Mins Read | October 29, 2025

Lead Generation Strategies for Insurance Companies (with form examples)

Insurance lead generation requires strategic form-first approaches. This comprehensive guide covers content marketing with gated forms, interactive quote estimators, ad-optimized landing pages, referral programs, and pre-qualification forms. Each strategy focuses on converting interest into qualified leads while building trust and providing immediate value to potential insurance customers.

The insurance business is heavily dependent on lead generation. Whether you’re selling life insurance, health insurance, or commercial insurance, your ability to consistently attract and convert potential clients is what fuels growth.

Unlike fast-moving consumer products, insurance is a considered purchase. Prospects take their time, compare providers, and evaluate trust before committing. And at the heart of all of it? Your lead capture form.

A steady, high-quality lead pipeline helps you:

- Keep your agents and sales teams productive

- Reduce acquisition costs over time

- And build predictable revenue from renewals and upsells

In this guide on insurance lead generation, we’ll show you how to use smart forms and form-first tactics to grow your business faster.

A well-designed, well-placed form can drastically improve both lead volume and quality.

Understanding the Insurance Buyer Journey

Before diving into tactics, it’s important to understand how today’s insurance buyers behave. Your potential customers might be:

- Casually browsing to learn more about different policies

- Comparing quotes across providers

- Or actively searching for the right plan to secure their future

In all cases, they’re looking for clarity, confidence, and ease, and most of this happens online.

That makes your form the first real interaction a lead has with your company.

If it’s intimidating, confusing, or too long - you’ve lost them. But if it builds trust and clearly shows intent? You’re golden.

Top Lead Generation Strategies (With Form-First Execution)

Now that we understand how users behave in the insurance buyer journey, it’s time to focus on action. The strategies we have selected for you below are all about converting interest into real, qualified leads using smart, form-first techniques.

Each of these methods puts the form front and center, making it the tool that captures, qualifies, and guides your next customer.

a. Content Marketing + Gated Lead Forms

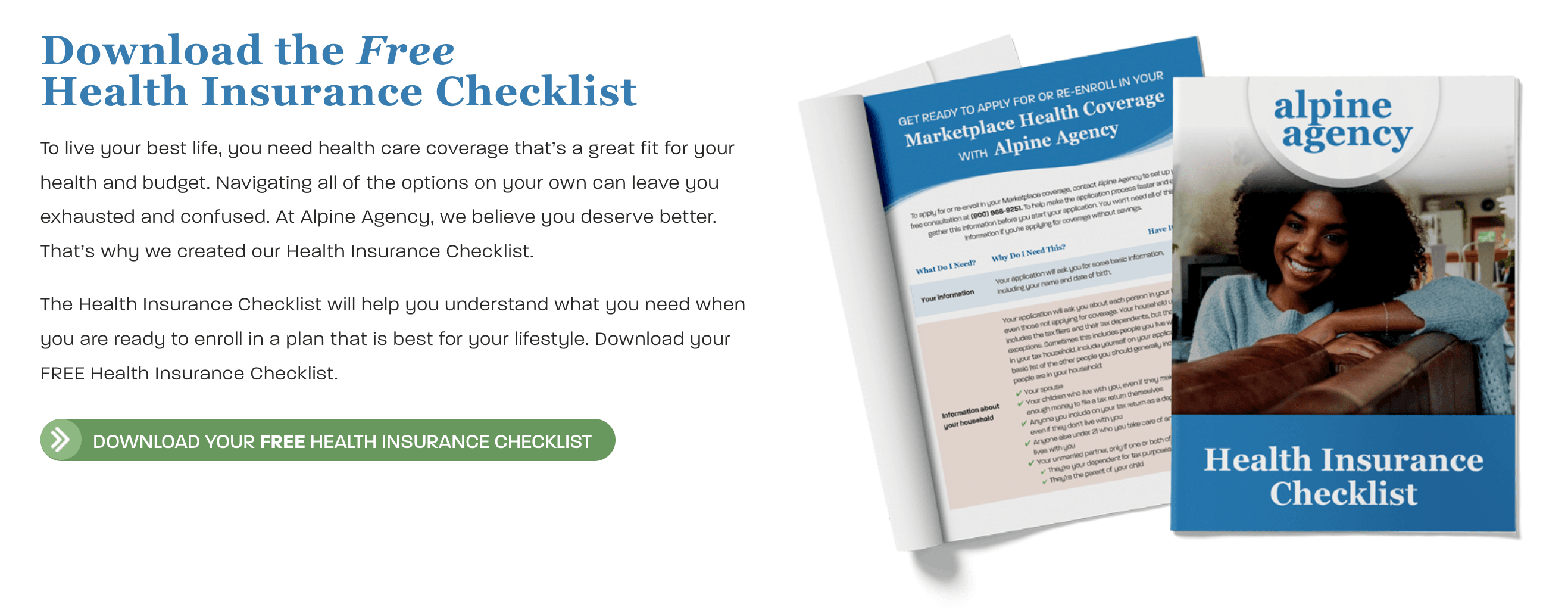

Content is still king, but only when paired with conversion! Educational blogs, checklists, and guides can pull in interest and you can even creat awesome content using best llm for creative writing even for your lead form that turns attention into action. Offer lead magnets like “Home Insurance Buying Guide” or “2025 Health Insurance Checklist”.

This is a real example of a lead magnet that works because it offers immediate, relevant value, a free checklist that simplifies a confusing insurance process. The clear benefit, paired with a friendly visual and compelling call-to-action, encourages users to exchange their info without hesitation.

b. Insurance Quote Estimators

Another great way to collect leads, while also providing value, is by helping users estimate their coverage needs on the spot. Instead of asking them to schedule a callback or wait for a quote, empower them with auto-generated estimates.

With the right structure, you can even turn this process into an interactive, quiz-like experience that actually helps users understand their options as they go. You can use auto calculated fields, and use conditional logic to tailor the experience, while collecting data.

Have a look at this life insurance lead form calculator by Northwestern Mutual, this is a perfect example of a form that informs while it converts.

By guiding users through a friendly, multi-step form that calculates their coverage, the quote calculator delivers immediate value. It doesn’t just blatantly ask for information to get a call back, it slowly builds trust with each question, and keeps the experience engaging until the final personalized estimate. That’s smart lead generation for life insurance done right.

c. Facebook & Google Ads Leading to Effective Forms

We all run Facebook and Google ads to attract leads, but often, the biggest drop-off happens after the click. If the landing page isn’t compelling, users bounce. That’s why the best thing you can do for your ads is to pair them with conversion-focused form pages.

With this you can take a more direct approach because by the time they’ve clicked your ad, they are already warmed up. At this point, they are looking for a fast and frictionless way to act.

These form examples from United Healthcare, take advantage of “decision mode”. They are offering clear paths, with “Shop for a plan” and Search for plans by ZIP code - making it easy for users to move forward.

You can even consider optimizing these forms further by including pre-filled fields or auto-location detection.

d. Referral Program Signup Forms

Something many of us forget is that your existing clients are one of your greatest untapped marketing assets! If someone is satisfied with their experience with you, your speed of service, clarity of coverage, or a successful claim, they’re definitely more likely to recommend you.

Make it easy for your clients to take action the moment they think, “I know someone who could use this.” This is a fantastic example from Vitality Insurance.

They’ve created a structured referral program that even has a reward, with which, they’ve added a strong emotional and financial incentive to spread the word!

All you need to do to create this for your insurance company, is to create a simple referral form to capture both parties' details, auto-validate submissions with OTP verification, and send confirmation emails!

e. Pre-Qualification Forms

Sometimes there are situations that are frustrating for both your prospects and your team - after spending time filling out lengthy forms, booking calls, or getting deep into the process only to discover they’re not even eligible. So much wasted time and unnecessary disappointment.

An awesome solution for this is an eligibility quiz-style form! These dynamic forms can help your users quickly determine if they qualify for a particular plan before taking up your team’s time. By doing this you’ve given them clarity upfront, built trust by being transparent, and reduced unqualified lead volume significantly. Here’s a simple example from Medical Outreach Ministries.

After just a few friendly, app-like questions, about age, location, and existing insurance, the form delivers a clear eligibility message right away. If someone doesn’t qualify, they find out immediately. No follow-up call, no time wasted. On the flipside, if they are eligible, you’ve just hit the jackpot!

You only need basic features like multi-step forms and conditional logic to create this highly effective form.

Want to build one right away? Here's how to create a lead capture form on MakeForms.

Must-Have Technical and Compliance Features in a Great Insurance Lead Form Maker

All the different types of forms we just explored, from quote estimators to referral forms, rely on your form builder doing some heavy lifting.

With the right form builder, you don’t have to write a single line of code to get there. No need to worry about how to design multi-step experiences, build conditional logic trees or ensure your data collection is compliant against all the laws and regulations!

Feature | Why It’s a MUST |

|---|---|

| Multi-step Format | It helps reduce user overwhelm by breaking complex questions (like DOB, coverage amount, or medical history) into bite-sized, manageable steps. Improves completion rates! |

| Diverse Input Types | Your form maker should have a variety of input options, like dropdowns, sliders, date pickers, multi-selects, and file uploads, to make forms more intuitive and mobile-friendly lead form optimization. |

| Conditional Logic | This is how you can dynamically show or hide questions based on user input, ensuring the form stays relevant, short, and tailored to each user’s insurance needs. |

| Progress Indicators | Adding this simple feature, provides a visual cue of how far along users are in the form, reducing form abandonment. |

| Auto-Validation | Can you imagine collecting leads and then finding out they’re fake! Pick a form maker that filters fake emails/numbers and helps Verify Leads with OTP verification over phone or email. |

| Mobile-First Design | Since the majority of users research insurance from their phones, a form that is automatically responsive and touch-friendly is essential. |

| TCPA-Compliant Checkboxes | If you are collecting phone data of customers inthe US, then you will need to include visible TCPA checkboxes, timestamp and IP logs. See our TCPA Compliance Checklist |

| GDPR & PIPEDA Compliance | If you're collecting data from users in the EU or Canada, your forms must comply with GDPR and PIPEDA regulations. This includes obtaining explicit consent, offering data access rights, and ensuring data is securely stored and processed. |

| HIPAA-Compliant Security | If your forms collect personal health information (PHI), especially for health insurance quotes, they must comply with HIPAA. Ensure your form platform offers data encryption, access control, and audit trails. |

Why MakeForms Ticks All the Boxes

MakeForms is purpose-built to support everything you’ve seen in this guide, from gated content and quote calculators to pre-qualification flows and referral programs. It brings together all the features your insurance lead forms need in one powerful, no-code platform.

With MakeForms, you can:

- Build complex, logic-driven forms with a simple drag-and-drop interface

- Easily implement multi-step flows, conditional logic, and auto-validation

- Stay compliant with built-in HIPAA, GDPR, PIPEDA, and TCPA features

- And finally, lead generation tool for insurance doesn’t stop at collecting data, you also need to nurture them. With MakeForms you can integrate with your CRM, email tools, and automation workflows to:

- Send a personalized email or SMS

- Trigger a CRM handoff or lead scoring workflow

- Let them book a consultation directly

Ready to Transform Your Insurance Lead Funnel?

Win the insurance industry by reaching out to the right people at the right time, in the right way. Traditional lead gen methods won’t cut it in today’s digital-first world. To stay ahead, you need to offer real value upfront, personalize every interaction, and remove friction at every step.

MakeForms helps you do exactly that. From eligibility quizzes to quote calculators and compliant referral programs, every feature is built to help you collect higher quality leads white staying fully compliant with data and consent regulations

So if you’re ready to build smarter, faster, and more effective lead funnels, create a lead capture form that leads you to success here.

lead formAlso, want to understand how different industries use lead forms? Check out these lead form examples for various industries.